Yesterday the provincial government tabled the legislation to enact the provincial flipping tax to go into effect January 1, 2025. The bill contains additional important details and clarifications related to the tax. They have been summarized below:

General Details:

• The flipping tax will apply to the taxable income on a property sold within 730 days of ownership. If the property is sold within 1 year the tax will be the full 20%, from 366 -729 days the tax will decrease on a pro-rated basis to zero.

• The tax applies to housing units, bare properties zoned for residential use and assignment sales or purchase contracts.

• The tax does not apply to property on First Nations Land .

• Properties purchased in 2023 and 2024 will be subject to the tax retroactively if sold within 730 days after January 1, 2025.

• The provincial flipping tax is separate and in addition to the federally administered anti-flipping rule.

Pre-sales and Assignments:

• For the purpose of the tax, people who have acquired a pre-sale contract will be considered to have acquired the property on the day they entered the contract.

• If you are assigned a pre-sale contract and close on the property, the date you were assigned the contract is considered the acquisition date for the purpose of the tax.

• Any profit gained from assigning a pre-sale contract will be subject to the flipping tax.

Exemptions:

• Exemptions for life circumstance such as death, divorce, illness, relocation for work, insolvency, etc. will be available.

• Exemptions for builders will be available such as if a housing unit is added to an existing property or property is purchased for the purpose of constructing buildings.

• Exemptions for certain entities such as registered charities, government, etc. are available.

The full list of exemptions and details can be found here

Primary Residence Deduction:

• Individuals who sell a primary residence within 730 days of ownership will be able to claim a deduction of $20,000 from their taxable interest if the property was their primary residence and they lived in it for at least 365 consecutive days before selling it.

Changes to Rules Governing Short-Term Rentals

________________________________________

Today the provincial government announced changes to the legislation governing short-term rentals. The changes are fairly comprehensive and cover the majority of aspects governing short-term rentals. The new regulations are intended to give municipalities and the province more power to regulate short-term rentals across the province. The intended changes are as follows:

Principal Residences Only

• As of May 2024, all short-term rentals in communities with populations 10,000 or over will be limited to principal residences only.

• Designated Resort communities, communities with populations under 10,000 will be exempt from the principal residence rule but can choose to implement if they wish to.

• In the interior of the province the communities included under this principal residence rule will be:

o Kelowna

o Kamloops

o Vernon

o Penticton

o West Kelowna

o Fort St. John

o Cranbrook

o Salmon Arm

o Lake Country

o Dawson Creek

o Summerland

o Coldstream

o Nelson

Fine Increases

• Fines for short-term rentals owner/operators breaking local municipal by-law rules will increase to $3000 per infraction, per day.

• Like municipalities, Regional Districts will be given the power to set the maximum penalty of $50,000 for severe contraventions of by-laws.

Data Sharing and Enforcement

• Short-term rental platforms will be required to share data with municipalities to improve local enforcement.

• It will also be mandatory for platforms to share information with the Province, including information about short-term rental hosts. The Province will have the ability to share this data with municipalities to coordinate regulation.

• Short-term rental platforms will be required to include businesses license and registration numbers on listings when they are required by a municipality.

• Regional Districts will be granted business regulation and licensing powers parallel to those of municipalities. This means Regional Districts will be able to require businesses, including short-term rental businesses, to obtain and maintain a business license to operate.

Non-Conforming Exemption

• The current exemption for short-term rentals operating in municipalities that restrict their use because they were operating prior to the by-law, often referred to as a non-confirming exemption, will be removed.

Provincial Registry and Enforcement Unit

• The province will create a short-term rental registry. Operators will be required to include a valid provincial registration number on their listings.

• Once established operators will have 3 months to register their companies and 6 months to register their units.

• A provincial enforcement unit will be established to issues orders and administer penalties.

Implementation is expected to be phased out throughout this year and 2024. The fines and bylaw powers will come into effect immediately upon royal assent of the bill. The principal residence rule, removing the non-conforming exemption and the requirement to display business licenses will come into May 2024. The provincial registry and data sharing requirements will come into effect summer to late 2024.

You can see the full government press release below.

Savoring Life in the Okanagan: The 2023 Wine Festival

By Cecile Guilbault PREC*, Okanagan Realtor, Coldwell Banker Horizon Realty

Watch online with cinematic landscapes of the okanagan

https://youtu.be/2pNladhOILc

The enchanting Okanagan Valley has long been celebrated for its picturesque landscapes, world-class wineries, and vibrant community. As we approach the 2023 Okanagan Wine Festival, I can't help but reflect on why this place I call home is such a remarkable and sought-after destination.

A Spectacle of Taste and Tradition

The Okanagan Wine Festival is more than just an event; it's a testament to the region's deep-rooted appreciation for the finer things in life. This year's festival promises an array of exquisite wines, gourmet dining experiences, and cultural celebrations that truly embody the spirit of the Okanagan.

But why stop at merely enjoying the festival as a visitor when you could make this incredible region your home?

A Lifestyle Beyond Compare

As a Realtor ® fortunate enough to call the Okanagan home for the past 28 years, I've had the privilege of helping countless individuals and families find their dream properties in this paradise. The Okanagan offers a lifestyle that goes beyond the festival's delicious wines and delectable cuisine.

Imagine waking up to breathtaking lake views and the sun-kissed vineyards right outside your doorstep. The Okanagan provides an unparalleled blend of natural beauty, outdoor activities, and a thriving community that welcomes all.

Why the Okanagan?

Natural Beauty: With its stunning lakes, lush orchards, and rolling vineyards, the Okanagan Valley is a nature lover's paradise. From hiking to watersports, there's always an adventure waiting just outside your door.

Wine Culture: The Okanagan is home to some of the world's most renowned wineries, making it a wine connoisseur's dream. Become part of the winemaking heritage by living in close proximity to these prestigious vineyards.

Community Spirit: The warmth and friendliness of the Okanagan community are unparalleled. Whether you're a wine enthusiast, foodie, artist, or outdoor adventurer, you'll find like-minded individuals who share your passions.

Economic Opportunities: The Okanagan isn't just about leisure; it's a region ripe with career opportunities. Many industries thrive here, from technology to agriculture, offering diverse career paths.

Unlock Your Okanagan Dream

As the 2023 Okanagan Wine Festival approaches, I invite you to experience the magic of this remarkable region for yourself. It's not just an event; it's an invitation to explore the possibility of calling the Okanagan home.

Whether you're drawn to the exquisite wines, the natural beauty, the welcoming community, or the economic opportunities, the Okanagan has something to offer everyone. Let this year's festival be the catalyst that inspires you to discover the Okanagan lifestyle and all the remarkable homes it has to offer.

If you're ready to take the next step in making the Okanagan your forever home, don't hesitate to reach out. I'm here to help you find your own piece of paradise in this extraordinary corner of the world.

Cheers to the 2023 Okanagan Wine Festival and the possibilities it may bring to your life in this exceptional region.

Cecile Guilbault PREC*

Phone: 250-212-2654

MEDIA RELEASE

Local Residential Market Sales Trending Upwards Heading into Spring

KELOWNA, B.C. – April 6 th, 2023. Residential real estate market moving in a positive direction for spring as sales activity picks up after a slow start at the beginning of the year, reports the Association of Interior REALTORS® (the Association).

A total of 1,207 residential unit sales were recorded across the Association region in March representing a 37.2% decrease in sales compared to the same month last year, yet up compared to February’s 831 unit sales.

“The upwards movement in sales activity compared to the previous month is showing signs that market activity is on its way to recovering from the previous month’s slump, while still maintaining healthy market activity,” says the Association of Interior REALTORS® President Lyndi Cruickshank, adding that “a more balanced market allows both parties to confidently move forward with their real estate aspirations.”

New residential listings saw an increase over the previous month’s 1,579 with 2,442 new listings recorded, despite a 15.7% decrease within the region compared to March 2022. Overall inventory saw a healthy 61.1% uptick with 5,903 units currently on the market at the close of March. The highest percentage increase in active listings was recorded in the South Okanagan with a total increase of 81% compared to the same month last year.

“This is the highest volume of new listings we’ve had for some time now, indicating that we are heading in a positive direction,” notes Cruickshank, adding “while we’re not out of the woods yet, this will help provide more options to buyers and sellers.”

“The spring months usually witness a surge in market activity, and REALTORS® will certainly be instrumental in providing adequate information and support during this period. Whether you are a buyer or a seller, it’s always a good idea to work with a real estate professional who can assist you in navigating current market conditions,” says Cruickshank.

The benchmark price for single-family homes in the Central Okanagan, North Okanagan, South Okanagan and Shuswap/Revelstoke regions all saw decreases in year-over-year comparisons, with the highest percentage decrease for single-family homes in the Central Okanagan region coming in at $1,001,500. The townhome and condominium categories all saw decreases across the various sub-areas in the benchmark price with the exception of townhomes in the North Okanagan, which saw a 9.2% increase compared to March 2022.

Given the high stakes on such a significant financial transaction, home sellers and buyers can benefit from the knowledge and skills of a practiced REALTOR®. Contact your local REALTOR® to find out more about the real estate market and how they can help you achieve your real estate goals

The Association of Interior REALTORS® is a member-based professional organization serving approximately 2,600 REALTORS® who live and work in communities across the interior of British Columbia including the Okanagan Valley, Kamloops and Kootenay regions, as well as the South Peace River region.

The Association of Interior REALTORS® was formed on January 1, 2021 through the amalgamation of the Okanagan Mainline Real Estate Board and the South Okanagan Real Estate Board. The Association has since also amalgamated with the Kamloops & District Real Estate Association and the Kootenay Association of REALTORS®

For more information, please contact:

Association statistical information: Email media@interiorrealtors.com

Province-wide statistical information:

BCREA Chief Economist, Brendon Ogmundson, bogmundson@bcrea.bc.ca

About HPI

The MLS® Home Price Index (HPI) is the most advanced and accurate tool to gauge home price levels and trends by using benchmark pricing rather than median or average. It consists of software tools configured to provide time-related indices on residential markets of participating real estate boards in Canada.

The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA (REALTOR®/Realt

129-4000 Trails Place, Peachland BC

The stats packages for members of the Association include monthly infographics, media releases and member exclusive in-depth sub-division breakdown of the regional areas.

Members can find the Association of Interior REALTORS® December 2022 Market Stats Packages on InterLink: https://secure.realtorlink.ca/naflogin/naflogin.aspx?SiteDomain=members.interiorrealtors.ca&targetURL=https%3A%2F%2Fmembers.interiorrealtors.ca%2Fdashboard&Cookiestest=y

December 2022 Stats Package direct download links: Okanagan/Shuswap, Kamloops & District, Kootenay Region, South Peace River. Archived media releases are available on our website

NOTE: Kamloops & District and the Kootenay region now have benchmark pricing. You can find out more about benchmark pricing at the section below. For an interim time period, the infographic for this area will include both average and benchmark prices for important property sub-types and benchmark pricing for sub-areas. Please contact media@interiorrealtors.com for assistance.

Learn more about Benchmark Pice here: https://mcusercontent.com/89e9acdeac700ed6d9d19c197/files/dffaf14b-1026-7c33-e32d-b24802a3ac82/HPI_KOOTENAYS_JULY_2022_CASE_STUDY.pdf

Canadian home sales edge up from September to October

Ottawa, ON, November 15, 2022 – Statistics released today by the Canadian Real Estate Association (CREA) show national home sales edged a little higher in October 2022.

HIGHLIGHTS

• National home sales were up 1.3% on a month-over-month basis in October.

• Actual (not seasonally adjusted) monthly activity came in 36% below October 2021.

• The number of newly listed properties edged up 2.2% month-over-month.

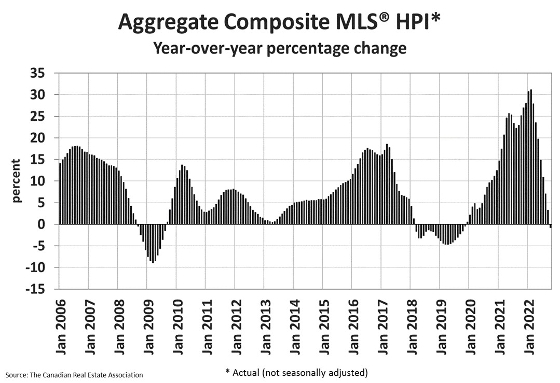

• The MLS® Home Price Index (HPI) declined by 1.2% month-over-month and was down 0.8% year-over-year.

• The actual (not seasonally adjusted) national average sale price posted a 9.9% year-over-year decline in October.

Home sales recorded over Canadian MLS® Systems fell by 3.9% between August and September 2022. From May through August, month-over-month declines have been progressively smaller. The September result marked a slight increase in the current sales slowdown that began with the Bank of Canada’s first rate hike back in March. (Chart A)

While about 60% of all local markets saw sales fall from August to September, the national number was pulled lower by the fact markets with declines included Greater Vancouver, Calgary, the Greater Toronto Area (GTA) and Montreal.

The actual (not seasonally adjusted) number of transactions in September 2022 came in 32.2% below that same month last year and stood about 12% below the pre-pandemic 10-year average for that month.

“In October, sales across the country increased for the first time since before interest rates started to rise last winter,” said Jill Oudil, Chair of CREA. “Of course, we’ve known the demand was there, so it’s just been a matter of some playing the waiting game as borrowing costs and prices have adjusted. Moving into 2023, sellers and buyers will likely continue coming off the sidelines, but it’s a very different market compared to just one year ago. As always, for information and guidance about how to navigate the current marketplace, your best bet is to contact your local REALTOR®,” continued Oudil.

“October provided another month’s worth of data suggesting the slow down in Canadian housing markets is winding up,” said Shaun Cathcart, CREA’s Senior Economist. “Sales actually popped up from September to October, and the decline in prices on a month-to-month basis got smaller for the fourth month in a row."

The number of newly listed homes was up 2.2% on a month-over-month basis in October, with gains in the Greater Toronto Area (GTA) and the B.C. Lower Mainland offsetting declines in Montreal and Halifax-Dartmouth.

With sales up by a little less than new listings in October, the sales-to-new listings ratio eased back to 51.6% compared to 52% in September. The long-term average for this measure is 55.1%.

There were 3.8 months of inventory on a national basis at the end of October 2022, up slightly from 3.7 months at the end of September. While the number of months of inventory is still well below the long-term average of about five months, it is also up quite a bit from the all-time low of 1.7 months set at the beginning of 2022.

The Aggregate Composite MLS® Home Price Index (HPI) edged down 1.2% on a month-over-month basis in October 2022, the smallest decline since June.

The non-seasonally adjusted Aggregate Composite MLS® HPI edged down 0.8% on a year-over-year basis in October. (Chart B)

The actual (not seasonally adjusted) national average home price was $644,643 in October 2022, down 9.9% from the same month last year. The national average price is heavily influenced by sales in Greater Vancouver and the GTA, two of Canada’s most active and expensive housing markets.

Excluding these two markets from the calculation cuts almost $125,000 from the national average price.

The legislation on housing targets, Housing Supply Act, is likely to face backlash from some B.C. mayors who have previously warned that running roughshod over municipal land use laws could spark a legal challenge.

On his first day in the Legislature, is B.C. Premier David Eby announcing two pieces of legislation that would remove rental and age restrictions in strata buildings and set affordable housing targets for municipalities, with the promise to overrule municipalities if they're failing to hit the benchmarks. PHOTO BY DARREN STONE /Times Colonist files

On his first day in the Legislature as premier, David Eby announced two pieces of legislation that would remove rental and age restrictions in strata buildings and set affordable housing targets for municipalities, with the promise to overrule those that fail to hit the benchmarks.

The legislation on housing targets is likely to face backlash from some B.C. mayors who have previously warned that running roughshod over municipal land-use laws could spark a legal challenge.

The housing announcement just three days after Eby was sworn in as B.C.’s 37th premier is an attempt by the former attorney general and housing minister to make good on his promise to move quickly on the housing reforms that were a key plank of his leadership campaign.

Amendments to the Strata Property Act, if passed, would remove all rental restrictions from all B.C. strata buildings, which Eby estimated would turn thousands of empty units into homes for renters.

It would also make it illegal for strata to have 19-plus age restrictions that force out young families when they have a child. “Seniors only” strata will still be allowed.

“It is simply unacceptable that a British Columbian who is searching Craigslist for a place to rent can’t find a home and somebody who owns a condo is not permitted to rent that home to that individual,” Eby said at a press conference in the rotunda of the legislature.

“It is equally unacceptable that a young couple that lives in a condo and decides to start a family has to start searching for a new home because that strata has a rule that everybody who lives in the unit has to be 19 years of age or older.”

Eby said there are approximately 2,900 strata units that are sitting empty because of rental restrictions, data based on owners who applied for exemptions to the speculation and vacancy tax.

The new law will apply to condos built before 2010. Buildings constructed in 2010 onwards are subject to new rules that prevent newer buildings from capping the number of rental units.

The government is hoping to pass the Strata Property Act before the end of the fall session on Thursday and will take effect immediately.

The second piece of legislation is the Housing Supply Act which aims to increase the supply of housing in B.C. by establishing targets for municipalities where affordable housing is in short supply.

The targets will be set based on the housing needs reports that local governments are already required to create every five years.

The government said the targets will initially be applied to eight to 10 municipalities, determined by community plans and growth projections based on census data. The premier’s office said work is already underway to identify those municipalities.

If the province determines a municipality is not taking actions to meet the targets, it can step in to force compliance through three options:

1. An adviser appointed by the housing minister can review municipal processes to determine what’s stalling housing starts.

2. The housing minister can issue a directive for the municipality to take specific action.

3. As a last resort, the province can issue an order-in-council allowing it to override the municipality to force through new housing projects.

“My hope is we never have to use it,” Eby said of the provincial override powers. “(The Act) does have teeth and it needs to have teeth to make sure we’re meeting those goals.”

The legislation aims to speed up municipal zoning approval processes, which Eby says are outdated and slow down the construction of new buildings and redevelopments. If passed in the house this week, the legislation will take effect in mid-2023.

Eby, the MLA for Vancouver-Point Grey, has been candid in his frustration with municipal governments that block the rezoning of affordable housing developments because of minor issues such as parking and he’s called out “NIMBYism” by neighbourhood groups that oppose density.

However, several B.C. mayors told Postmedia News in September, when Eby released his housing platform, that the plan to override municipalities will face significant backlash and they would rather see the province use the “carrot approach” of offering more financial support and incentives instead of wielding a stick.

Victoria Mayor Marianne Alto applauded the legislation and said other municipalities should, too.

She said municipalities must accelerate the building of affordable housing and they can’t do it alone.

“We need the province to support to push us and push all local governments to (build) … more affordable homes in every neighbourhood in every municipality across B.C,” she said.

B.C. Green party leader Sonia Furstenau said she was disappointed Eby didn’t make announcements about increasing the supply of below-market housing for low-income renters. She also said the legislation does not include protection against Real Estate Investment Trusts which allow investment groups to redevelop strata housing to increase shareholder profits.

“We need to ensure that speculators and investors are not profiting from increased supply,” Furstenau said in a statement. “This problem has been made worse by a lack of federal and provincial government investment in non-market housing.”

There are several aspects of Eby’s housing platform that have not yet been acted on.

Eby’s platform called for a flipping tax that will apply to the sale of a residential property. The tax rate, which was not specified, will be highest for those who hold properties for the shortest period of time and goes down to zero after two years.

He also wants to legalize secondary suites in every region in B.C. and allow developers to replace a single-family home with up to three units in major urban centres.

The housing overhauls are complex and take time, Eby said, but he promised work is underway.

The Canadian Federal Government & BC Provincial Government plan to introduce 2 pieces of legislation in January 2023 which will affect some BC Real Estate Buyers and Sellers.

Here are some basic details, so that you can check whether they affect you!

Ban on Foreign Buyers of Residential Real Estate in Canada

From January 2023 the Federal Government plans to impose a temporary ban on Non-Canadians purchasing various types of residential real estate, for 2 years. This is featured in the Prohibition on the Purchase of Residential Property by Non-Canadians Act 2022

There is a fair amount that we don’t know yet, for example, have they finished creating exemptions.

So all Non- Canadian Buyers who are thinking of making a purchase, make your purchase before the end of December!

Buyers should also speak to their Canadian Real Estate Lawyer, about the implications of this Act, and how it may affect them, to avoid any nasty surprises or fines.

Full details of the proposed Act are shared in the link below.

BC Home Buyers Rescission Period

This legislation is expected to come into practice from January 2023. It will bring into force a ‘Cooling Off’ period for Buyers. This will allow a Buyer who has an Accepted Offer in place to be released from the deal within 3 business days. The 3-day period starts the day after the Contract is signed.

This will apply to Residential & Manufactured Homes, and there will be a fee for triggering the rescission of the Real Estate Contract. All other conditions will not be affected.

A Buyer who uses this right to rescind will be subjected to a 0.25% fee. This will apply to any transactions made using a Real Estate Agent and ‘For Sale by Owner’, and will be payable to the Seller.

There are some exceptions – E.G certain forms of Lease Land, Assignments of Contract, Court ordered sales and sales via Auction.

Each Buyer will also receive a Disclosure from their Real Estate Agent detailing the Rescission Fee.

KELOWNA, B.C. – January 5th, 2022. Residential real estate across the region from Revelstoke to Eastgate Manning Park and into the South Peace River region finished off the year with record high sales, reports the Association of Interior REALTORS®.

Residential sales for the entire Association region for December 2021 saw a down tick of 25% over December 2020, clocking in at654 units sold while still surpassing the previous recorded historical high.

“Even with a typical seasonal slowdown, sales across the region surpassed 2016’s record high,” says the Association of Interior REALTORS® President Kim Heizmann, adding that “the lack of supply continues to be a challenge for buyers as inventory lags behind demand.”

The supply of active residential listings saw a drop of 40% across the Association region compared to the 2,894 active listings during December 2020, with new listings also showing a 24% decrease over December 2020’s 695 units.

“The number of active listings continues to fall short of buyer’s demand at historical levels, making it unlikely for buyers to see a softening on prices as we head into the new year,” says Heizmann.

The benchmark price for homes in the Central Okanagan, North Okanagan, South Okanagan and Shuswap/Revelstoke region sclosed the year with double-digit percentage increases in year-over-year comparisons across all home categories.

In the South Peace River Region, where benchmark pricing is not available, the average price for single-family homes and mobile homes increased 44.5% and 56.9% respectively.

Contact your local REALTOR® to find out more about the real estate market and how they can help you achieve your real estate goals.

The Association of Interior REALTORS® was formerly formed on January 1, 2021 through the amalgamation of the Okanagan Mainline Real Estate Board and the South Okanagan Real Estate Board.

The Association is a member-based professional organization serving over 1,700 REALTORS® who live and work in communities across the interior of British Columbia from Revelstoke south to the US border, east to Rock Creek, west to Eastgate Manning Park to communities in the South Peace River region.

For more information, please contact: Association statistical information: Email media@interiorrealtors.com Province-wide statistical information: BCREA Chief Economist, Brendon Ogmundson, bogmundson@bcrea.ca (mailto:media@interiorrealtors.com)

About HPI The MLS® Home Price Index (HPI) is the most advanced and accurate tool to gauge home price levels and trends by using benchmark pricing rather than median or average. It consists of software tools configured to provide time-related indices on residential markets of participating real estate boards in Canada.

The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA (REALTOR®/ REALTORS®).

KELOWNA, B.C. – April 6th, 2021. Residential real estate sales across the region from Revelstoke to Eastgate Manning Park and into the South Peace River region are still seeing the effects of the pandemic, reports the Association of Interior REALTORS®.

Residential sales for the month of March were up 146% with 1,763 units sold compared to March 2020’s 708 units. The South Peace River and the Shuswap/ Revelstoke regions saw the highest increase of sales with a 225% and 223% upswing compared to the same time last year.

“With economic recovery underway, low mortgage rates and the persistent pandemic effect of buyers looking for more space, it’s no surprise that local real estate is still seeing a boom,” says the Association of Interior REALTORS® President Kim Heizmann, adding that “while the pandemic has increased demand it also created a huge shock to the supply side of things that will take a long time to get back to a healthy inventory level.”

The total number of active residential listings for March from Revelstoke to Peachland was down 46% compared to March 2020’s listings of 1,814. In the South Okanagan region overall listings dropped 52% over last March’s 1,255, while the South Peace River saw a 16% decrease compared to last year’s 345 listings.

“Buyers are struggling to find homes and the lack of supply is putting upward pressure on pricing,” says Heizmann. “It is really important to work with a local REALTOR® who not only understand the market but also that buyers are looking for homes for their families, not just a house to live in.”

The benchmark price for homes in the Central Okanagan, North Okanagan and Shuswap/Revelstoke regions saw double-digit percentage increases in year-over-year comparisons in the single-family and townhomes categories.

In the South Okanagan, where benchmark pricing is not yet available, average sales prices were also up year-over-year in all home categories with single-family homes seeing the highest percentage increase of 42%. The average sale prices for single-family homes in the South Peace River increased 27% in comparison to March 2020 prices.

The Association of Interior REALTORS® was formerly formed on January 1, 2021 through the amalgamation of the Okanagan Mainline Real Estate Board and the South Okanagan Real Estate Board.

The Association is a member-based professional organization serving approximately 1,600 REALTORS® who live and work in communities across the interior of British Columbia from Revelstoke south to the US border, east to Rock Creek, west to Eastgate Manning Park to communities in the South Peace River region.

Contact your local REALTOR® to find out more about the real estate market and how they can help you achieve your real estate goals.

For more information, please contact:

Board-wide statistical information: Email media@interiorrealtors.com

Province-wide statistical information:

BCREA Chief Economist, Brendon Ogmundson, bogmundson@bcrea.ca

About HPI The MLS® Home Price Index (HPI) is the most advanced and accurate tool to gauge home price levels and trends by using benchmark pricing rather than median or average. It consists of software tools configured to provide time-related indices on residential markets of participating real estate boards in Canada.

The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA (REALTOR®/ REALTORS®).

KELOWNA, B.C. – February 3rd, 2021. Residential real estate sales once again hit a record high in the first month of 2021 across the region from Revelstoke to Eastgate Manning Park and into the South Peace River region, reports the Association of Interior REALTORS®.

The total number of sales in January was up 60% with 796 units sold compared to January 2020’s sales of 497. In the Shuswap and Revelstoke region property sales where up 50% from 40 units in 2020 to 60 in January 2021. The South Okanagan region, stretching from Summerland to Eastgate Manning Park saw the highest increase of dollar volume with a 136% hike compared to the same time last year.

“Hikes in sale dollar volume is another impact of COVID-19 as buyers are seeking out larger spaces to improve their living conditions,” says the Association of Interior REALTORS® President Kim Heizmann, adding that “larger homes naturally also come with a larger price tag. However, we are still seeing an upward pressure on pricing driven by a shortage of inventory that is unable to meet consumer demand.”

Active residential listings for January from Revelstoke to Peachland remained on par with December 2020’s listings but remained short 37% compared to January 2020’s inventory of 2,806. In the South Okanagan region overall listings remained low as decreases were noted in all housing categories. Inventory for condominiums remains low in the South Peace River region with a 27% decrease compared to the same period last year.

“A chronic shortage of new condominium developments in areas such as the South Peace River region or Revelstoke makes it even harder for inventory to meet demand, particularly when such areas are driven by recreational property purchases,” says Heizmann.

The benchmark price for single-family homes in the Central Okanagan, North Okanagan and Shuswap/Revelstoke regions saw increases in year-over-year comparisons with the most notable increase being in 14% in the single-family category.

In the South Okanagan, where benchmark pricing is not yet available, average sales prices showed double-digit increases year-over-year, while average sale prices for condominiums in the South Peace River are rose 69% in comparison to January 2020 prices.

The Association of Interior REALTORS® was formerly formed on January 1, 2021 through the amalgamation of the Okanagan Mainline Real Estate Board and the South Okanagan Real Estate Board.

The Association is a member-based professional organization serving approximately 1,600 REALTORS® who live and work in communities across the interior of British Columbia from Revelstoke south to the US border, east to Rock Creek, west to Eastgate Manning Park to communities in the South Peace River region.

Contact your local REALTOR® to find out more about the real estate market and how they can help you achieve your real estate goals.

For more information, please contact:

Board-wide statistical information: Email media@interiorrealtors.com

Province-wide statistical information:

BCREA Chief Economist, Brendon Ogmundson, bogmundson@bcrea.ca

About HPI The MLS® Home Price Index (HPI) is the most advanced and accurate tool to gauge home price levels and trends by using benchmark pricing rather than median or average. It consists of software tools configured to provide time-related indices on residential markets of participating real estate boards in Canada.

The trademarks MLS®, Multiple Listing Service® and the associated logos are owned by The Canadian Real Estate Association (CREA) and identify the quality of services provided by real estate professionals who are members of CREA (REALTOR®/ REALTORS®).

Cecile Guilbalt Group

Coldwell Banker Horizon Realty

#14 - 1470 Harvey Avenue

Kelowna, BC, Canada

V1Y 9K8

Cecile Guilbault Cell: 250-212-2654

Julia Debolt Cell: 250-864-2400

Jan Marsden Cell: 250-808-2123

Cecile Guilbault Email: cecile@cecileguilbault.com

Julia Debolt Email: julia@cecileguilbault.com

Jan Marsden Email: jan@cecileguilbault.com